Looking for mortgage payoff tips? We’ve got a secret – small payments = BIG money. With 30-year fixed mortgage rates hitting levels not seen in 25 years, even a small increase in your monthly payment can significantly reduce the total interest you pay over the life of your mortgage. By making slight adjustments, you can save thousands and pay off your mortgage much sooner.

The Impact of Small Additional Payments

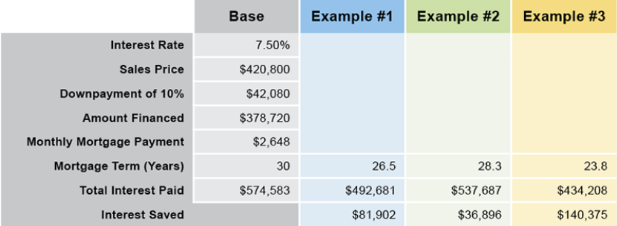

Let’s take a look at a few scenarios to see how adding just a bit more to your monthly mortgage payment can make a big difference.

The Assumptions:

- Home price: $420,800 (the average U.S. home price in early Q3 2024)

- Mortgage rate: 7.50%

- Down payment: 10%

- Loan type: 30-year fixed-rate mortgage

- Monthly payment: Principal and interest only (excluding property taxes, homeowner’s insurance, and mortgage insurance)

In this base scenario, without any extra payments, you would pay a total of $574,583 in interest alone over the 30-year mortgage term—that is nearly $1 million total for a $420,800 value home! Fortunately, you can avoid paying that much with just a few strategic extra payments.

The Scenarios:

Scenario #1: Adding $100 to Your Monthly Payment

By adding just $100 extra per month to your mortgage payment, you would save $81,902 in interest and pay off your mortgage 3½ years earlier. Are there any memberships you aren’t utilizing, subscriptions you forgot to cancel, dining out or ordering in? There is an easy $100 right there!

Scenario #2: Lump-Sum Payments at Years 5, 15, and 25

In this scenario, you make a lump-sum payment of $5,000 in years 5, 15, and 25 of your mortgage. While it doesn’t shorten your mortgage term as much, you’ll still save nearly $37,000 in interest over time. Save about $84 per month to reach $1,000 per year for five years. If you receive bonuses at work, tax refunds, or other unexpected windfalls, put them directly into your lump-sum savings.

Scenario #3: Adding $200 to Your Monthly Payment

If you can manage an extra $200 a month, you’ll save $140,000 in interest and shave 6 years off your mortgage term. That’s a huge impact from a small monthly adjustment. Overpaying for insurance, phone, or cable? Time to negotiate, you’ve got interest to save!

Scenario #4: Do Nothing and Pay More Interest than the Home Value

Wait a second……

Every Little Bit Helps

Paying off your mortgage early doesn’t require massive lump sums. Even a modest increase, like $10 more each month, can save you nearly $10,000 over the life of your mortgage. That’s a significant amount that stays in your pocket rather than going to the bank.

Whether it’s $10, $100, or $200 a month, every extra bit helps you move closer to financial freedom and a more secure future for your family.